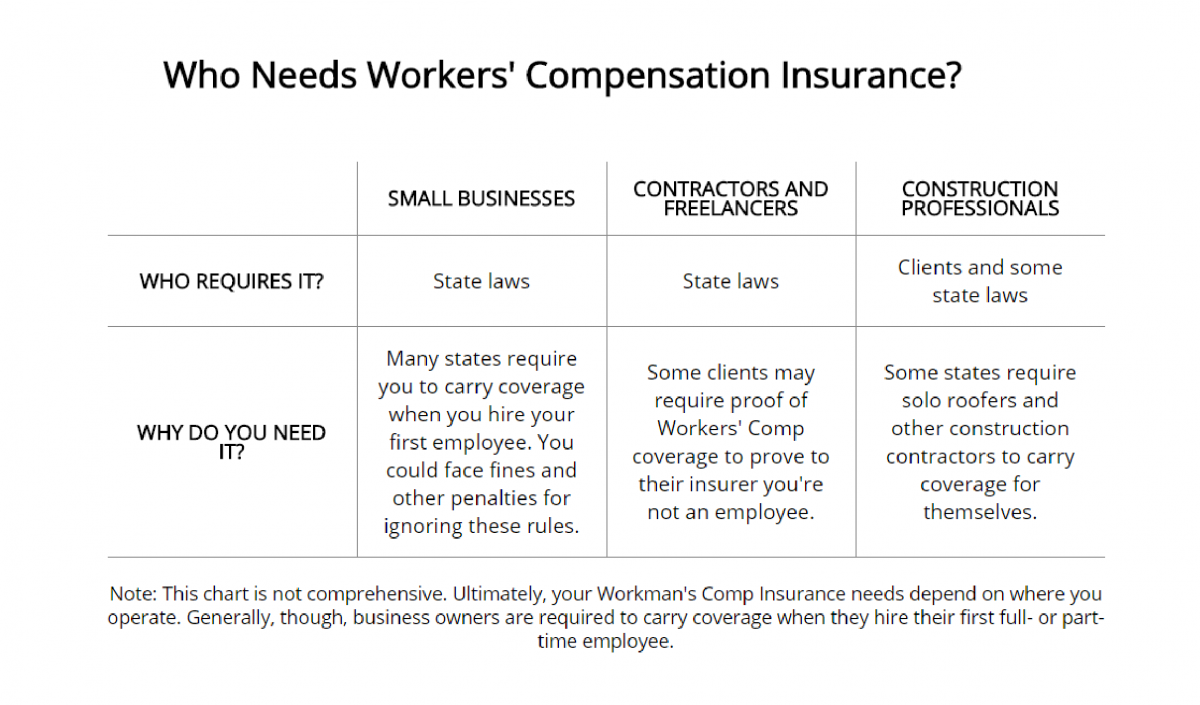

A workmen compensation insurance policy is a commercial insurance policy that covers the legal liability of an employer to provide compensation to its workmen in case of their death or accident.

Workmen compensation insurance policy tariff.

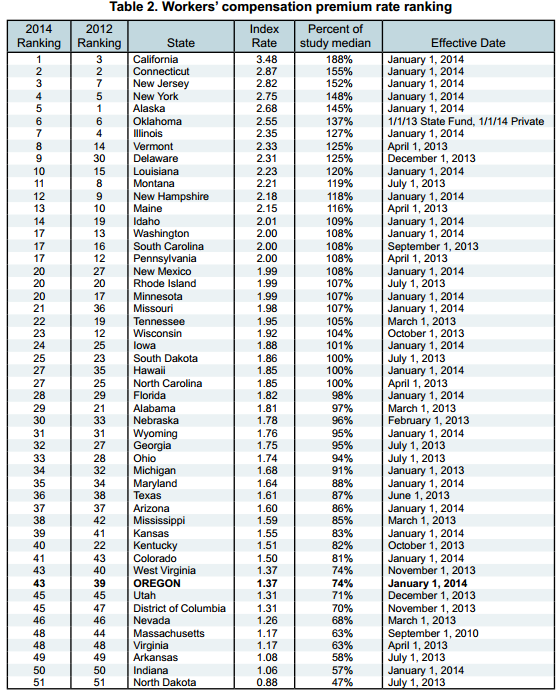

The class code is assigned a rate that is based on each 100 00 of payroll.

The workmen s compensation insurance business in india is controlled by the workmen s compensation insurance tariff w c tariff.

Premium rating is governed tariff.

Indemnity against legal liability for accident to employees under.

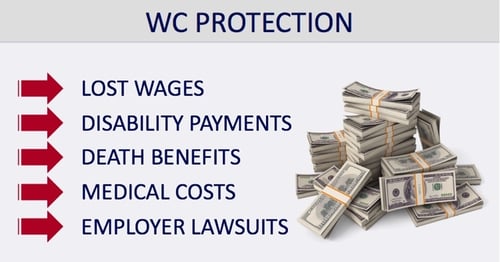

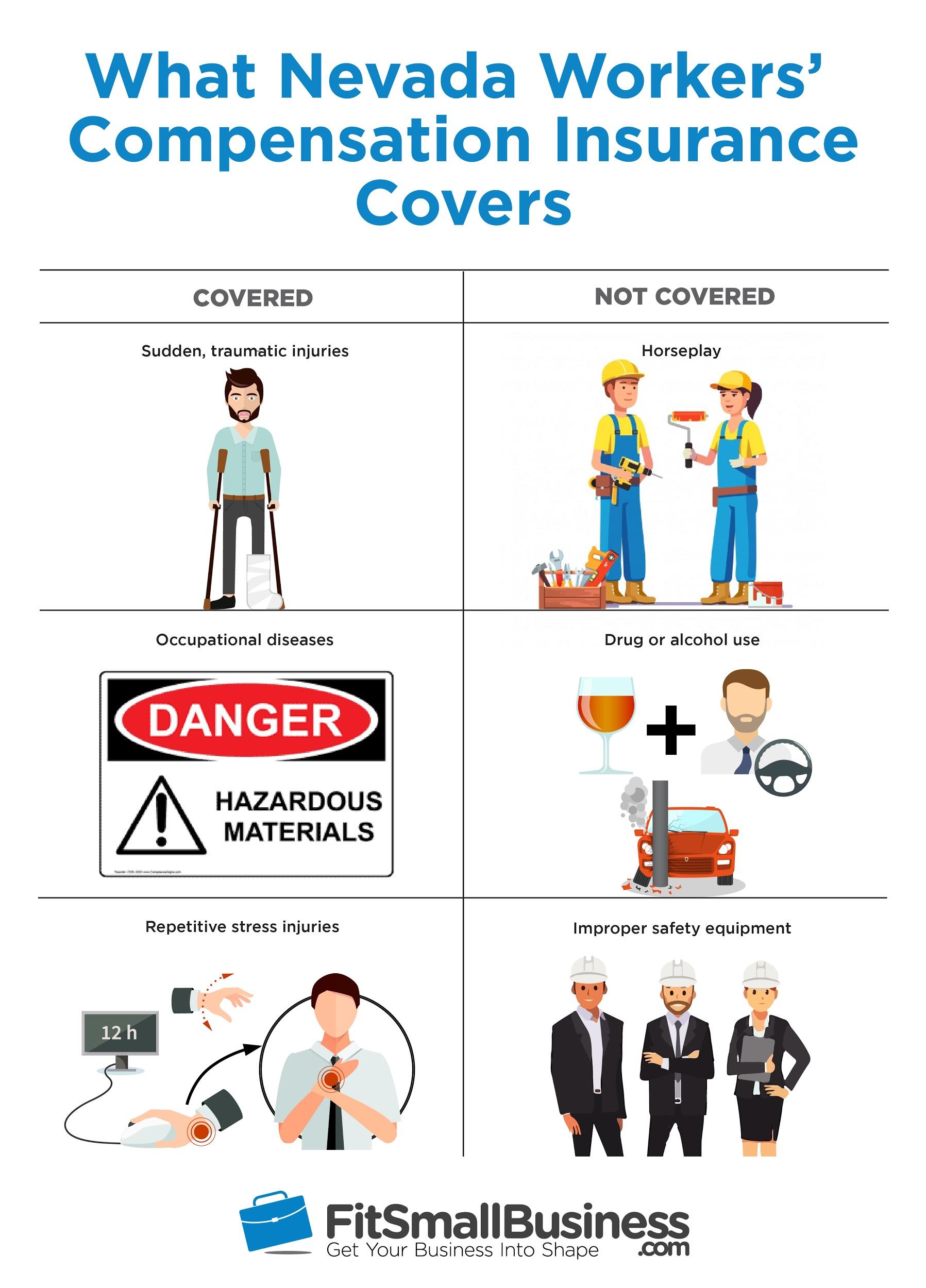

This coverage can include rehabilitation services and death benefits too.

The average salary you would want the insurer to consider for benefits estimation the occupations of employees to be covered and.

Workers compensation insurance is also called workman s compensation or workman s comp.

Workmen s compensation insurance policy policy wordings page 1 of 4 bajaj allianz general insurance company limited ge plaza airport road yerewada pune 411006 reg.

The tariff provides for two types of insurance as follows.

The policy provides for two forms of insurance viz table a indemnity against legal liability to all employees whether or not coming within the definition of the term workmen under the w c act 1923 and subsequent amendment to the said act prior to the date of issue of the policy the fatal accidents act 1855 and at common law.

Tariff prescribes 2 forms of insurance table a.

Workmen compensation insurance tariffs are determined based on the valuations of insurance information bureau of india iib.

A work comp rate of 2 5 equates to 2 50 per every hundred dollars of payroll in that class code.

The premium amount depends on.

The basis of determining premium for a workers compensation policy is payroll.

It depends on the nature of work carried on by the insured.

Worker s compensation insurance also called workers comp helps cover medical expenses and lost wages for small business owners if an employee is injured or becomes sick.